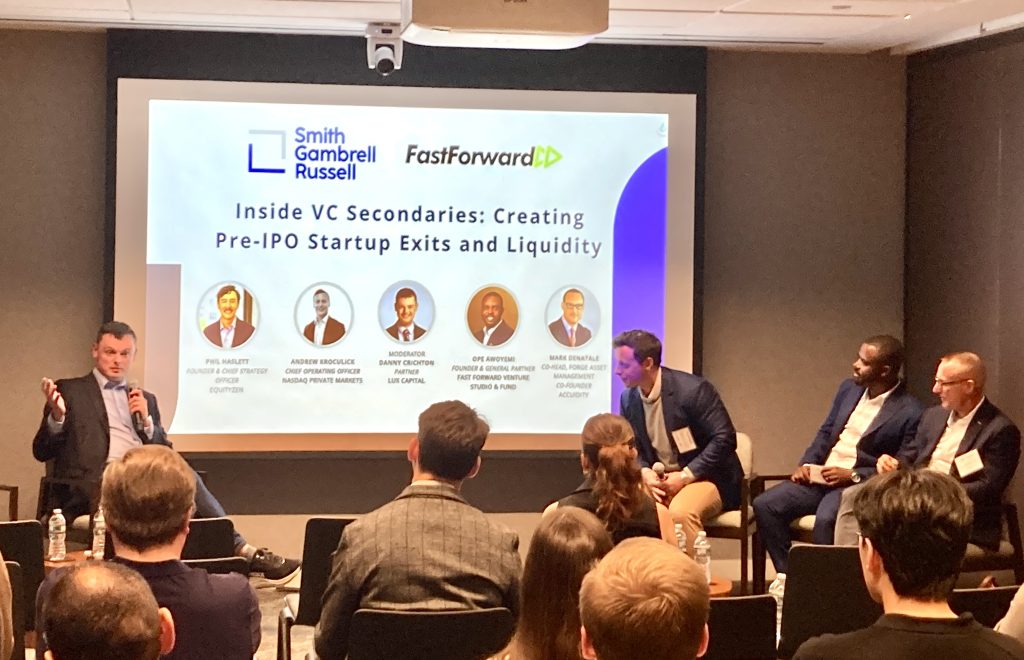

Nasdaq Private Market, Forge, and EquityZen Headline Fast Forward’s NYC Pre-IPO Secondaries Event

Fast Forward hosted our first NYC event, a panel on the hot topic of secondaries—the booming market for private shares of pre-IPO startups.

This is a VC trend that you need to follow (if not) and follow more (if you already are). As venture backed companies stay private longer, investors and employees want earlier options to realize liquidity. Pre-IPO secondaries sales are serving that demand.

Fast Forward’s debut NYC event and reception delved into all parts of this emerging space with a stellar panel billing, stacked with speakers from Nasdaq Private Market, Forge, and EquityZen.

Our moderator, Lux Capital Partner Danny Crichton, led a terrific discussion, drawing out these panelist perspectives before a packed house:

Our moderator, Lux Capital Partner Danny Crichton, led a terrific discussion, drawing out these panelist perspectives before a packed house:

Our moderator, Lux Capital Partner Danny Crichton, led a terrific discussion, drawing out these panelist perspectives before a packed house:

Our moderator, Lux Capital Partner Danny Crichton, led a terrific discussion, drawing out these panelist perspectives before a packed house:

-

- Nasdaq Private Market’s COO Andrew Kroculick offered a sense of scale, highlighting that In 2024, NPM’s total proceeds raised through secondary private tender offers exceeded VC-backed IPO volume of $5.4 billion.

- Forge Asset Management Co-Head Mark DeNatale spoke to platform innovations being introduced to reduce risk and open up access to private market stock purchases.

- Fast Forward MP Ope Awoyemi, underscored rising demand for secondaries opportunities for emerging markets and African founded tech unicorns.

- And EquityZen Founder Phil Haslett made perhaps the boldest statement on the timeliness of the topic without speaking at all. He had to withdraw from the panel last minute when his company was officially acquired by Morgan Stanley (just hours before).

- Fast Forward is grateful to co-host Smith Gambrell Russell for providing their midtown Manhattan venue, our moderator, panelists, and all who attended our debut NYC event.